can you file an insurance claim without a police report Can you file an accident claim without a police report

Here are some valuable tips on how to file your car insurance claim effectively:

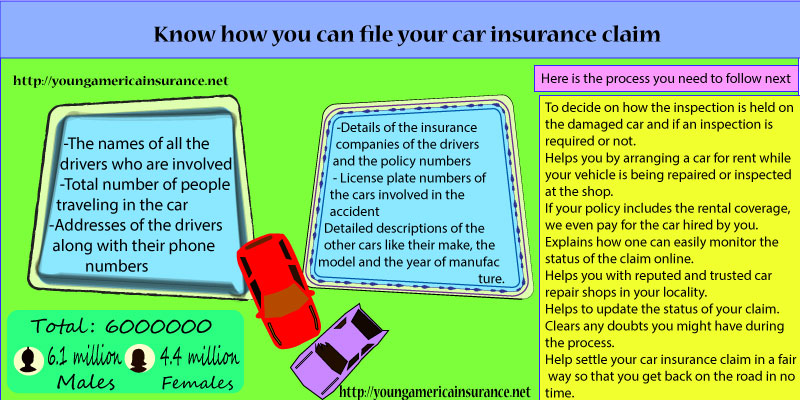

Know How You Can File Your Car Insurance Claim

When it comes to filing a car insurance claim, it's important to understand the process and know your rights. Here is a step-by-step guide on how to effectively file your car insurance claim without any complications:

1. Report the Incident Promptly

As soon as an incident occurs, such as an accident or theft, it is crucial to report it to your insurance provider promptly. The sooner you inform them, the better it is for you as it ensures a smooth claim process.

2. Gather Necessary Information

Collect all the relevant information related to the incident, including the date, time, location, description of the incident, and any other details that might be helpful in supporting your claim. Additionally, take photographs of the scene, damages, and any injuries sustained.

3. File a Police Report (If Required)

In cases where there is significant damage, injuries, or potential liability issues, it is advisable to involve the police. Reporting the incident to the authorities helps provide an official record of the incident and can strengthen your insurance claim.

4. Contact Your Insurance Provider

Reach out to your insurance carrier's claims department and notify them about the incident. They will guide you through the claim process, provide necessary forms, and explain any coverage details specific to your policy.

5. Fill Out the Claim Forms

Complete all the required claim forms accurately and comprehensively. Be sure to include all the necessary supporting documents, such as the police report, photographs, and any other evidence that validates your claim.

6. Cooperate with the Insurance Adjuster

Once you submit your claim, an insurance adjuster will be assigned to assess the damages and determine the extent of coverage. Cooperate with the adjuster, provide them with all the requested information, and be available to answer any questions they might have.

7. Review the Settlement Offer

After evaluating your claim, the insurance company will provide a settlement offer. Review it carefully and ensure that it covers all your legitimate losses, such as vehicle repairs or replacement, medical expenses, and other damages.

8. Negotiate if Needed

If the settlement offer doesn't seem fair or doesn't adequately compensate you for your losses, you have the right to negotiate. Provide additional evidence or information to support your stance and work towards reaching a mutually acceptable agreement.

9. Keep Documentation

Maintain a record of all correspondence, documents, and communication related to your claim. This includes copies of claim forms, emails, letters, and receipts. Having a well-organized file will help you stay organized and provide evidence if any disputes arise.

Insurance Coverage Details

Understanding your insurance coverage is crucial when filing a claim. Here are some essential coverage details you should be aware of:

- Liability Coverage: This coverage protects you if you are responsible for causing damage to someone else's property or injuries.

- Collision Coverage: It covers the cost of repairing or replacing your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects against non-collision incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault. It may also cover lost wages and other related costs.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you are involved in an accident with an uninsured or underinsured driver.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions regarding car insurance claims:

Q: Is it necessary to involve the police in all car insurance claims?

A: In minor incidents, involving the police might not be necessary. However, if there are significant damages or injuries, it is wise to involve them to have an official record of the incident.

Q: How long does the car insurance claim process take?

A: The duration of the claim process varies depending on the complexity of the claim, availability of documentation, and the efficiency of communication between all parties involved. It can take anywhere from a few days to several weeks.

Q: Will filing a car insurance claim affect my premiums?

A: Filing a claim can potentially impact your future premiums. However, the specific impact will depend on various factors, including the circumstances of the claim, your insurance provider's policies, and your previous claims history.

Remember, it is crucial to familiarize yourself with your insurance policy and understand the specific requirements, coverage, and claim procedures. Following these guidelines will help ensure a smooth and successful process when filing your car insurance claim.

Post a Comment